Sukanya samriddhi yojana Account, important Sukanya Samriddhi Yojana upsc notes. Sukanya samriddhi yojana tax benefit for Parents. Sukanya samriddhi yojana upsc

Table of Contents

Sukanya Samriddhi Yojana UPSC | What is Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana is a Government Scheme especially for the Betterment of The Girl child. The Scheme was launched by Prime minister Narendra Modi on 22 January 2015 as a Part of the Beti Bachao Beti Padhao initiative. This account can be Opened by the Parents of a Girl Child below the Age of 10. It can be opened at designated Banks or Post offices.

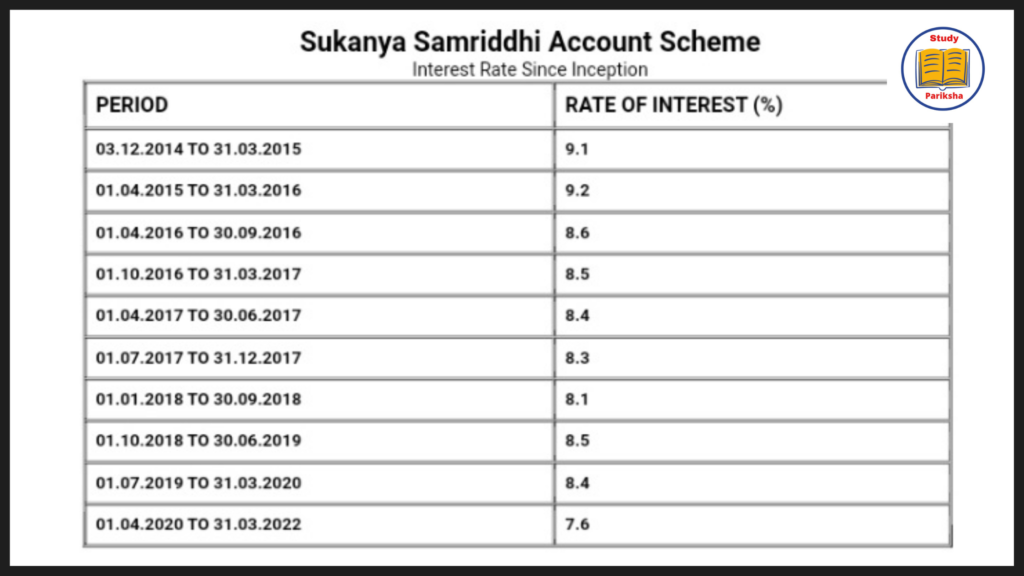

| Ineterst Rates | 7.6% per annum ( Q3 FY 2021-22 |

| Maturity Period | 21 years or until the girl child marries after the age of 18 |

| Minimum Deposit Amount | Rs 250/- |

| Maximum Deposit Amount | Rs 1.5 Lakhs in a Fnancial Year |

| Eligibility | Parents or Legal Guardian of a girl child below the age of 10 are eligible to open the SSY in the name of the Girl Child. |

| Income tax Revoice | Eligible for rebate under section 80C of the income tax Act 1961 ( Maximum cap of Rs 1.5 Lakh in a year ) |

- Minimum Deposit Rs 250/- Maximum Deposit of 1.5 Lakh in a Financial year

- Account can be opened in the Name of a girl child till she attains the age of 10 years

- Only one Account can be opened in the name of a girl child

- Account can be opened in post offices and in Authorised banks

- Withdrawal Shall be allowed for the purpose of higher Education of the Account holder to meet Education Expenses.

- The Account can be Prematurely Closed in in case of marriage of girl child after her attaining the age of 18 years.

- The Account can be transferred anywhere in India from one post office/bank to another.

- The Account shall Mature on completion of a period of 21 years from the date of opening of Account.

Sukanya Samriddhi Yojana Tax Benefit for Parents

At the time of the Launch of the Sukanya samriddhi scheme, only the deposits in the Account were eligible for tax deduction under section 80C of the Income Tax Act, but now the Government has changed some rules and tax exemption in the Sukanya Samriddhi Yojana Account.

- Sukanya Samriddhi Yojana offers a Higher fixed rate of return of 7.6% per annum for Q3 Financial year 2021-22

- Sukanya Samriddhi scheme Provides Tax deduction benefits under Section 80C up to Rs 1.5 Lakh Annually as we mentioned above.

- The Parents can make a Minimum Deposit of Rs 250 in a year and a Maximum Deposit of Rs 1.5 Lakh in a year.

- The Account can be Easily transferred from one part of the country to another Post office or bank account.

Sukanya Samriddhi Yojana Eligibility Details

- The Girl Child has to be below the age of 10 years at the time of Opening of the account.

- Only one Account can be opened in the Name of a Girl Child

- One parent or Legal Guardian can only open up to two Accounts for their girl children

- If parents have twins or triplets they can open up to three Accounts as per the Government rules.

- If a Girl child is born after the birth of Twin Girls, a third Sukanya Samriddhi Account cannot be opened.

How to Fill Sukanya Samriddhi Yojana Form

You can Apply for this Scheme through your nearby post offices public banks or Private banks. You will need to submit your KYC Documents like Aadhar card, passport. You can also get Application form for the Sukanya Samriddhi Account from the post office and banks, you can also download the application form online or you can download from below. There are some details which you can Fill in the Application form given below

- Name of the Girl Child ( Primary Account Holder )

- Name of the Parent or Guardian Opening the account

- Deposit Amount

- Cheque or DD number used for Deposit Amount

- Date of Birth of Girl Child

- Birth certificate details of Girl child

- Parents Aadhar card or ID details

- Present and Permanent address proofs Photocopies

Download Sukanya Samriddhi Yojana Form PDF and Other Forms

Application Form for Opening Sukanya Samriddhi Account

Application Form for Loan Withdrawal Form

Apllication Form for Transfer of Account

Application Form for Extension of Account

Application for Premature Closure of Account

Sukanya Samriddhi Yojana Form PDF Lists

FAQs ( Frequently Asked Questions )

Is Premature Closure of Sukanya Samriddhi Yojana Account Allowed?

Yes, Premature Closure of the Sukanya Samriddhi Account is allowed in some certain cases. Due to some illness of the Primary Account Holder or unexpected demise of the Account holder.

What is the Penalty If I Missed my Sukanya Samriddhi Account minimum Annual payment ?

There will be a Penalty of Rs 50 If the Minimum Amount of Rs 250 is not deposited in the account during A financial year

Is there any Tax on SSY Account Interest?

No, Sukanya Samriddhi Yojana is a Completely Exempt from Tax, the interest earned as well as the Maturity Amount are all tax Exempt.

Do we increase the installment amount year by year in Sukanya samriddhi Yojana?

Yes, You can Increase the amount Year by year you can Deposit any amount in the Sukanya Samriddhi Account.

Application form of withdrawal of amount from for Sukanya Yojana

You can Download The Form Given Above in the Form List, Click on the Withdrawal form and Download it

Thank you for sharing Sukanya Samriddhi Notes! I appreciate you taking the time to share this valuable information. It’s great to see people sharing knowledge and helping others understand important topics like these. Keep up the good work!

You may also check my accounting services:

Accounting services in Delhi