The Stand Up India Scheme, launched in 2016 by Prime Minister Narendra Modi, aims to promote economic empowerment and job creation at the grassroots level by facilitating bank loans to underbanked sections of society. This article provides a comprehensive analysis of the scheme, encompassing its objectives, key features, eligibility criteria, application process, and recent updates, catering specifically to UPSC aspirants.

Table of Contents

Stand Up India Scheme Launch Date:

August 15, 2016

Stand Up India Bank List:

All Scheduled Commercial Banks (SCBs) operating in India are mandated to participate in the scheme. Some prominent banks include:

- State Bank of India (SBI)

- ICICI Bank

- HDFC Bank

- Axis Bank

- Bank of Baroda

Stand Up India Application Form:

Interested individuals can apply for loans through their nearest bank branch or online via the Stand Up India portal (https://www.standupmitra.in/). The portal provides a standardized online application form for all participating banks.

How to Apply for Stand Up India Scheme:

- Eligibility Check: Ensure you meet the eligibility criteria mentioned below.

- Choose Bank: Select a participating bank and visit their branch or online portal.

- Download Application Form: Fill out the application form with necessary details and supporting documents.

- Submit Application: Submit the completed application form along with required documents to the chosen bank.

- Loan Processing: The bank will assess your application based on eligibility, creditworthiness, and project viability.

- Loan Approval: Upon successful evaluation, the bank will sanction the loan amount.

Stand Up India Scheme for Women:

Women entrepreneurs hold a special place in the scheme. They are eligible for loans under the Stand Up India category regardless of their caste or tribe. Additionally, several government schemes offer subsidies and other benefits specifically for women entrepreneurs.

Objectives of Stand Up India Scheme:

- Facilitate bank loans between ₹10 lakh and ₹1 crore to at least one Scheduled Caste (SC), Scheduled Tribe (ST), and woman entrepreneur per bank branch.

- Promote grass-roots entrepreneurship and job creation.

- Increase financial inclusion and empower marginalized communities.

- Encourage greenfield enterprises in manufacturing, services, Agri-allied activities, and the trading sector.

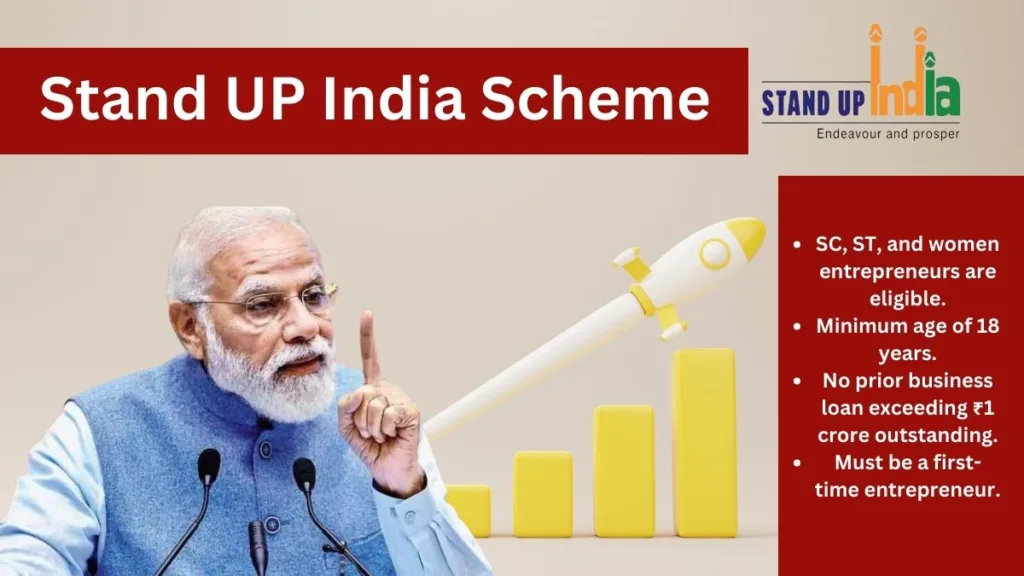

Stand Up India Eligibility:

- Individual Entrepreneurs:

- SC, ST, and women entrepreneurs are eligible.

- Minimum age of 18 years.

- No prior business loan exceeding ₹1 crore outstanding.

- Must be a first-time entrepreneur.

- Non-Individual Enterprises:

- At least 51% owned and controlled by SC, ST, or women entrepreneurs.

- Registered as a partnership firm, limited liability partnership (LLP), or private limited company.

- No prior government loan exceeding ₹1 crore outstanding.

Recent Updates (as of February 2024):

- The government has extended the scheme’s validity until March 2025.

- The focus has shifted towards promoting social entrepreneurship and green businesses.

- Several state governments have launched additional schemes to support Stand Up India beneficiaries.

Conclusion:

The Stand Up India Scheme UPSC holds immense significance in India’s economic development journey. By empowering aspiring entrepreneurs from underbanked sections, it can create jobs, boost financial inclusion, and contribute to inclusive growth. UPSC aspirants should thoroughly understand the scheme’s nuances and its potential impact to excel in their examinations.

Important Links:

- Stand Up India Portal: https://www.standupmitra.in/

- Ministry of Finance Website: https://www.finmin.nic.in/

- SIDBI Website: https://www.sidbi.in/

My name is Mohit sharma I am a Professional content writer having experience in Digital marketing. I write latest content related to Technology and business.